Catalogue

Our gold and silver bars and coins

Silver bars without VAT tax

Silver bars exempt from VAT tax

31.1 kg

Silver ingot 1'000 Ounces / About 31.1 Kg (exempt form VAT)

Silver bars exempt from VAT tax

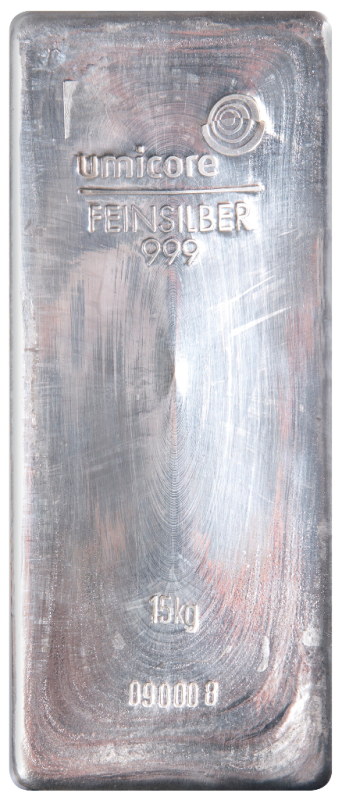

15 kg

Silver ingot 15 kg (exempt form VAT)

Silver bars exempt from VAT tax

5 kg

Silver ingot 5 kg (exempt form VAT)

Silver bars exempt from VAT tax

1 kg

Silver ingot 1 kg (exempt form VAT)

VAT information:

Our products and services prices are shown excluding taxes, to which must be added the value added tax (or not – see the various cases in the table below), to obtain a total including taxes.

| delivery method | silver | gold |

|---|---|---|

| IN SWITZERLAND | ||

| storage | Swiss VAT 7.7% | exempt |

| shipping | Swiss VAT 7.7% | exempt |

| pick up from site | Swiss VAT 7.7% | exempt |

| CUSTOMS BONDED | ||

| open customs bonded warehouse | exempt | exempt |

| EXPORT | ||

| shipping | destination country VAT | exempt |

ADDITIONAL SERVICES (certificate of authenticity, shipping fees, storage fees, etc.) are fiscally linked to the metal to which they refer. Thus, for example, if a silver ingot is stored in Switzerland, the VAT also applies to the storage costs. However, if a silver ingot is stored "customs bonded", the storage costs are exempt from any tax. As another example, if a package containing 500 g of gold and 7 kg of silver is sent to a Swiss address, part of the shipping fee is tax-exempt, the other part incurs tax prorated to the gold value / silver value of the package.

For answers to frequently asked questions (FAQ) go to our website > FAQ page > Tax/VAT. To read them now, click here.